The 2026 Reality: Why Your FAR is a Legal Document

Implementing a robust Fixed Asset Verification Checklist is the most critical step for companies aiming to maintain CARO 2026 compliance and financial integrity. In the current regulatory landscape, a Fixed Asset Register (FAR) is no longer just an internal spreadsheet; it is a critical legal document. For CFOs and Auditors, the risk isn’t just a “missed item”—it’s an audit qualification under CARO 2020.

As we navigate the 2026 audit cycle, the shift toward digital-first evidence means manual, paper-based verification is becoming a major compliance red flag.

1. What is Fixed Asset Verification? (Beyond the Basics)

Fixed Asset Verification is the systematic process of physically validating the existence, location, and condition of a company’s non-current assets.

The Goal: To ensure that the “Physical Reality” on the factory floor or office matches the “Financial Reality” in your General Ledger.

The Core Components of Modern Verification:

- Physical Inspection: Verifying the asset’s “As-is” state.

- Smart Tagging: Implementing QR, Barcode, or RFID systems.

- Geotagging: Validating the “Situation of Assets” as required by law.

- Reconciliation: Closing the gap between the book balance and physical count.

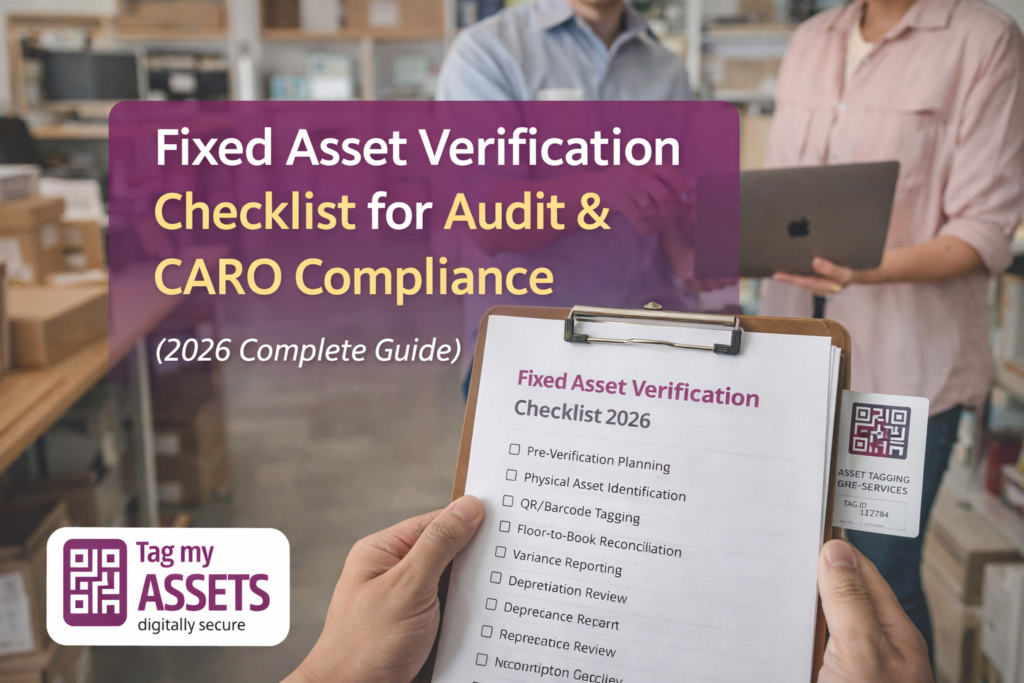

Step-by-Step Fixed Asset Verification Checklist” to “The Ultimate Fixed Asset Verification Checklist for 2026

2. CARO 2020/2026 Compliance: What Auditors Look For

Under Clause 3(i) of CARO 2020, the auditor’s microscope is focused on four specific areas:

- Comprehensive Records: Does the FAR include quantitative details and precise locations?

- Verification Intervals: Has management conducted physical checks at “reasonable intervals” (typically every 3 years, though annually is the 2026 gold standard)?

- Material Discrepancies: Were variances found? If so, were they properly adjusted in the books?

- Title Deeds: Is the legal ownership of immovable property clearly established in the company’s name?

Audit Alert: If your verification hasn’t been done in the last 3 years, you are at high risk of a CARO adverse remark.

3. The Definitive 2026 Fixed Asset Verification Checklist

Phase 1: Pre-Verification Strategy

- [ ] Freeze the Books: Stop all asset additions/disposals in the ERP/Software during the audit window.

- [ ] Clean the Data: Remove obvious duplicates in the FAR before hitting the floor.

- [ ] Define Hierarchy: Categorize by Asset Class (IT, Plant & Machinery, Furniture).

Phase 2: Physical Execution & Tagging

- [ ] Unique Identification: Ensure every asset has a unique TagMyAssets QR code.

- [ ] Condition Coding: Use a standard scale (e.g., New, Working, Idle, Obsolete).

- [ ] Serial Number Capture: Vital for high-value electronics and machinery to prevent “swapping.”

Phase 3: The Reconciliation Matrix (The “Hard” Part)

| Verification Type | Action Required | Compliance Impact |

| Book-to-Floor | Trace FAR entries to physical items. | Identifies Ghost Assets (Overstated Profit). |

| Floor-to-Book | Record items found that aren’t in FAR. | Identifies Unrecorded Assets (Understated Wealth). |

| Location Audit | Match current location vs. recorded location. | Corrects Departmental Costing. |

Export to Sheets

4. Financial Risks of Ignoring Asset Integrity

Ignoring this process isn’t just a compliance “oops”—it has real bottom-line consequences:

- Depreciation Leaks: Paying depreciation on assets that no longer exist.

- Insurance Overpayments: Paying premiums for “Ghost Assets.”

- Tax Risks: Inaccurate asset values lead to incorrect tax filings and potential penalties.

- Theft & Misuse: Without tagging, movable assets like laptops and tools “walk out” unnoticed.

5. How TagMyAssets Automates Your Audit Trail

Manual verification is prone to human error. TagMyAssets bridges the gap between the physical floor and the auditor’s report:

- Mobile-First Verification: Our app allows teams to scan and verify in seconds.

- Instant Variance Reports: Generate “Missing vs. Found” reports automatically.

- Digital Evidence: Attach photos and GPS coordinates to every asset for the auditor.

- Clean FAR: We don’t just find assets; we help you restructure your register for a clean audit.

6. Frequently Asked Questions (FAQ)

How often is fixed asset verification required?

While CARO suggests “reasonable intervals” (once every three years), most high-growth companies and IT firms conduct annual verification to maintain 100% accuracy.

What is a “Ghost Asset”?

A ghost asset is an item recorded in your Fixed Asset Register that is no longer physically present or usable. They inflate your balance sheet and cause you to pay unnecessary taxes and insurance.

Why use QR Codes instead of Barcodes for 2026?

QR codes hold more data, are easier to scan with standard smartphones, and can be linked to dynamic digital records that include maintenance history and photos.

Final Thoughts for 2026

Fixed Asset Verification is no longer a “once-in-a-while” chore—it is a cornerstone of financial hygiene. By following this checklist, you ensure your organization remains compliant, efficient, and audit-ready.By following this Fixed Asset Verification Checklist, your organization will be ready for any statutory audit.

Ready to modernize your asset management? [Contact TagMyAssets for a Professional Verification Audit Today]